Wealth Management Platform Market Trends, Scope & Forecast 2025-2033 from robbyrobinson's blog

Global Wealth Management Platform Industry: Key Statistics and Insights in 2025-2033

Summary:

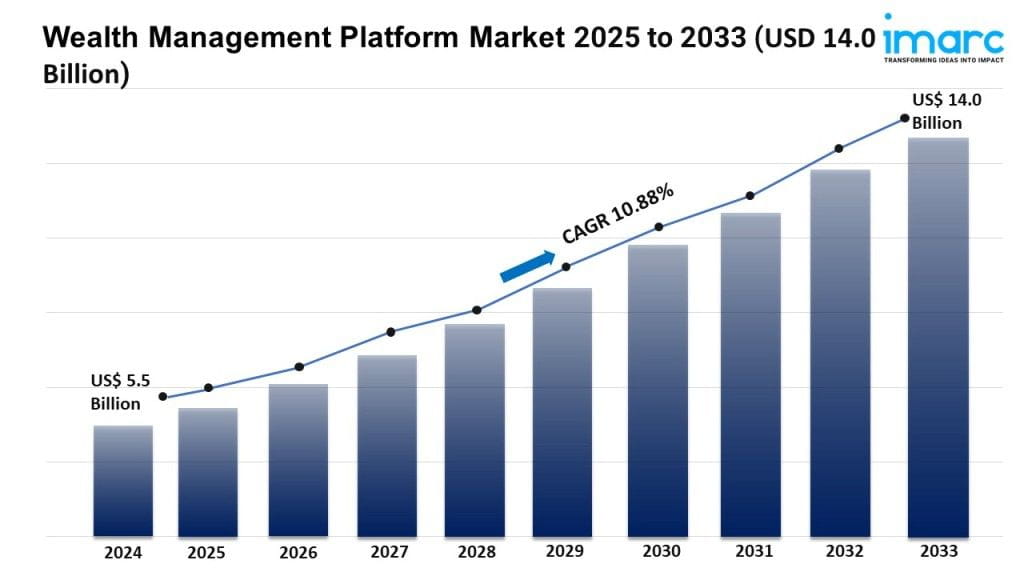

- The global wealth management platform market size reached USD 5.5 Billion in 2024.

- The market is expected to reach USD 14.0 Billion by 2033, exhibiting a growth rate (CAGR) of 10.88% during 2025-2033.

- North America leads the market, accounting for the largest wealth management platform market share.

- Human advisory accounts hold the largest market share in the advisory model segment because they provide tailored strategies, emotional intelligence, and trust, which are hard to match with automated or robo-advisory models.

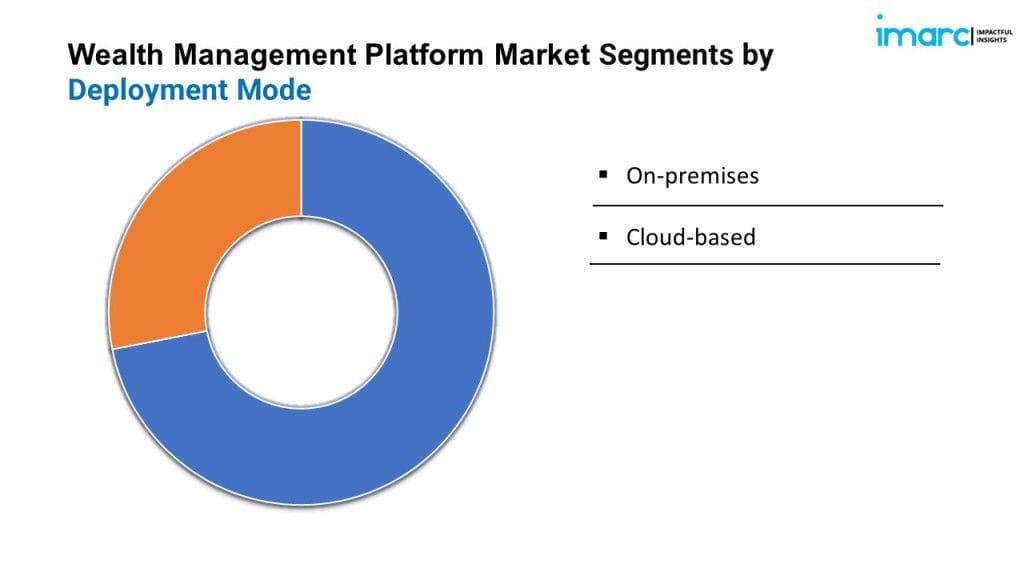

- Cloud-based solutions hold the largest market share in the wealth management platform industry.

- The market has been classified into several categories based on business function, including reporting, performance management, financial advice management, risk and compliance management, portfolio management, accounting and trading management, and others.

- The market has been divided into two categories based on enterprise size: large enterprises and small and medium-sized enterprises.

- The growth of the affluent population is driving the wealth management platform market.

- The wealth management platform market is being reshaped by the growing focus on digital transformation..

Industry Trends and Drivers:

- Growing affluent population:

As the number of high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) is increasing, there is a rise in the demand for advanced wealth management services. These individuals often seek personalized investment strategies, estate planning, and tax optimization, driving the need for sophisticated wealth management platforms that can offer these services. The accumulation of wealth among the affluent population leads to an increase in assets under management (AUM). Wealth management platforms are essential for managing larger portfolios, tracking investments, and optimizing returns for high-value clients. Affluent individuals expect tailored financial solutions that align with their unique goals and risk tolerance. Wealth management platforms that offer customization and personalization features are in high demand to meet these expectations.

- Digital transformation:

Digital transformation allows wealth management platforms to offer online and mobile access, making it easier for clients to manage their investments, view portfolios, and conduct transactions anytime and anywhere. This increased accessibility drives higher adoption rates and client satisfaction. Advanced digital tools enable wealth management platforms to provide highly personalized services. Using data analytics and AI, platforms can offer tailored investment recommendations, customized financial plans, and targeted advice based on individual client profiles and preferences. Automation of routine tasks, such as portfolio rebalancing, transaction processing, and report generation, reduces operational costs and enhances efficiency. Digital platforms streamline these processes, allowing wealth managers to focus on more strategic tasks and improve overall service delivery.

- Technological advancements:

The integration of artificial intelligence (AI) and machine learning (ML) into wealth management platforms allows for sophisticated data analysis and predictive modeling. These technologies enable platforms to provide personalized investment advice, optimize portfolios, and anticipate market trends more accurately. Technology enables the automation of portfolio management tasks, such as rebalancing and asset allocation. Robo-advisors, which use algorithms to manage investments, are becoming increasingly popular for their efficiency and cost-effectiveness, attracting a wider range of clients. The use of big data analytics allows wealth management platforms to process and analyze vast amounts of data from various sources. This helps in gaining insights into market conditions, client behavior, and investment performance, leading to more informed decision-making and tailored investment strategies.

Grab a sample PDF of this report: https://www.imarcgroup.com/wealth-management-platform-market/requestsample

Wealth Management Platform Market Report Segmentation:

Breakup By Advisory Model:

- Hybrid

- Robo Advisory

- Human Advisory

Human advisory represents the largest segment. Human advisors offer personalized, trust-based financial advice that remains highly valued by clients, especially for complex wealth management needs.

Breakup By Deployment Mode:

- On-premises

- Cloud-based

Cloud-based accounts for the majority of the market share as cloud-based platforms offer scalability, flexibility, and cost-efficiency, making them the preferred choice for wealth management firms.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position in the wealth management platform market on account of its large concentration of high-net-worth individuals (HNWIs) and strong adoption of advanced financial technologies.

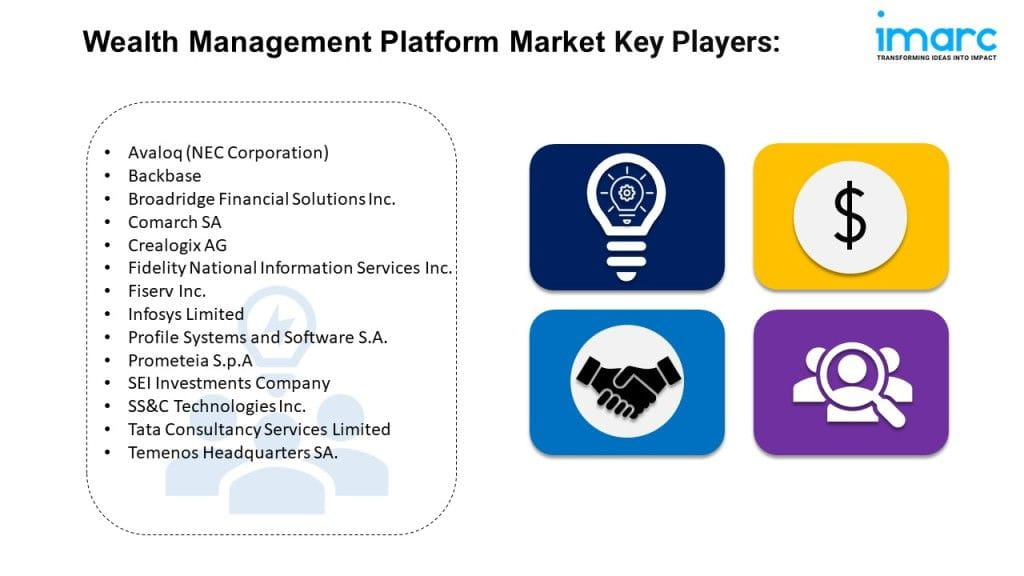

Top Wealth Management Platform Market Leaders:

The wealth management platform market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Avaloq (NEC Corporation)

- Backbase

- Broadridge Financial Solutions Inc.

- Comarch SA

- Crealogix AG

- Fidelity National Information Services Inc.

- Fiserv Inc.

- Infosys Limited

- Profile Systems and Software S.A.

- Prometeia S.p.A

- SEI Investments Company

- SS&C Technologies Inc.

- Tata Consultancy Services Limited

- Temenos Headquarters SA.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

The Wall