Bioenergy Market Share, Key Players, Trends & Forecast 2025-2033 from robbyrobinson's blog

Global Bioenergy Industry: Key Statistics and Insights in 2025-2033

Summary:

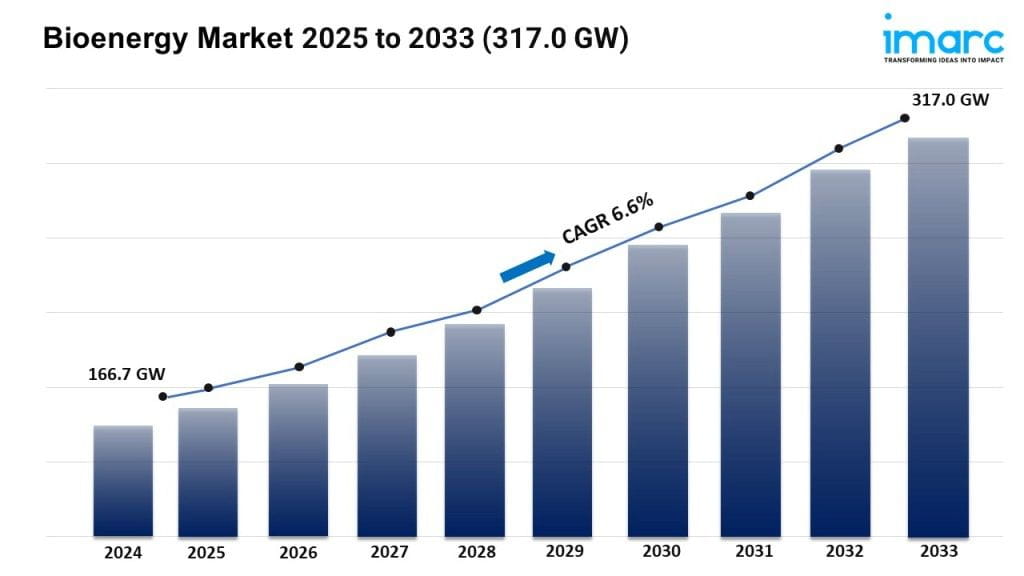

- The global bioenergy market size reached 166.7 GW in 2024.

- The market is expected to reach 317.0 GW by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033.

- Europe leads the market, accounting for the largest bioenergy market share.

- Due to worries about the detrimental effects of conventional fossil fuels, liquid biofuel holds the largest market share in the product type group.

- The bioenergy industry's primary component is solid waste.

- Because of the growing need for a sustainability in transportation applications, the transportation sector continues to dominate the market.

- One of the main factors propelling the bioenergy industry is a growing environmental concerns.

- The market for bioenergy is changing as a result of rising energy demand and technological developments.

Industry Trends and Drivers:

- Increasing environmental concerns:

The utilization of organic materials, including crop residues, forestry waste, and organic municipal trash, makes bioenergy a renewable energy source. These materials emit fewer greenhouse gases when they are transformed into biofuels or used to generate biopower than fossil fuels like coal, oil, and natural gas. The fight against climate change, a serious environmental issue, is aided by this emission decrease. Moreover, the burning of fossil fuels emits chemicals that lead to respiratory ailments and air pollution, such as sulfur dioxide, nitrogen oxides, and particulate matter. However, because bioenergy technologies emit fewer harmful pollutants, air quality is improved and the negative effects of pollution on the environment and human health are lessened.

- Rising energy demand:

As the demand for energy is rising worldwide, there is a growing concern about ensuring a stable and secure energy supply. Bioenergy contributes to energy security by diversifying the energy mix and reducing dependence on finite fossil fuel resources, which may be subject to geopolitical uncertainties and supply disruptions. In addition, bioenergy can be produced from a wide range of organic materials, including agricultural residues, forestry waste, energy crops, and organic municipal solid waste. These biomass resources are often locally available and renewable, providing a reliable and sustainable source of energy to meet the growing demand, particularly in regions with abundant biomass resources.

- Technological advancements:

Innovations in biomass conversion processes, such as pyrolysis, gasification, and fermentation, are leading to higher yields of bioenergy products like biofuels and biogas. These advancements enhance the overall efficiency of bioenergy production and make it more economically viable. Furthermore, the development of biorefineries, which integrate multiple biomass conversion processes to produce a variety of bio-based products, is expanding the market opportunities for bioenergy. Biorefineries enable the efficient utilization of diverse feedstocks and the maximization of value-added product streams, driving innovations and competitiveness in the bioenergy sector.

Grab a sample PDF of this report: https://www.imarcgroup.com/bioenergy-market/requestsample

Bioenergy Market Report Segmentation:

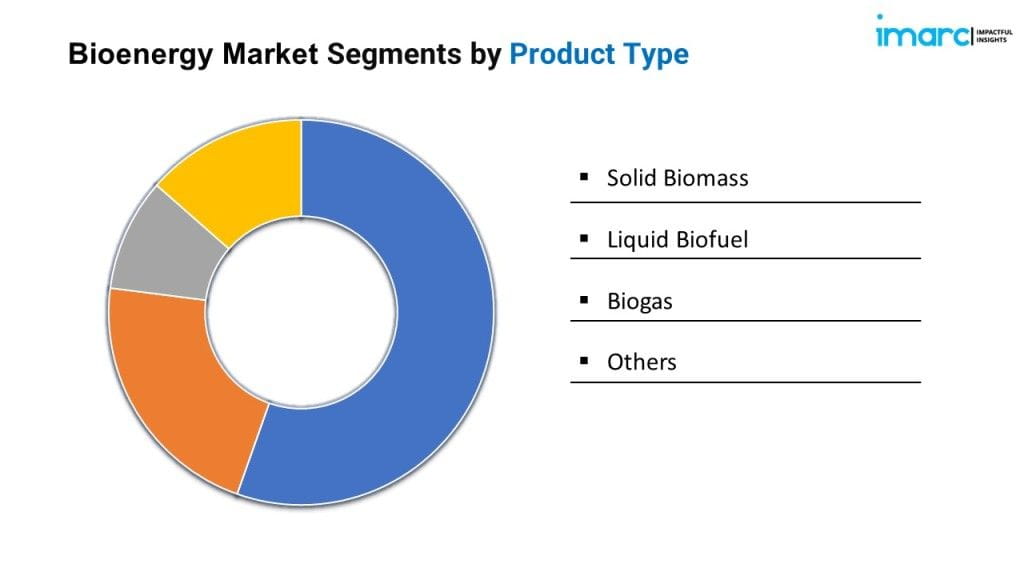

Breakup By Product Type:

- Solid Biomass

- Liquid Biofuel

- Biogas

- Others

Liquid biofuel represents the largest segment as it offers a direct substitute for conventional fossil fuels like gasoline and diesel, making them more readily adoptable within existing infrastructure and transportation systems.

Breakup By Feedstock:

- Agricultural Waste

- Wood Waste

- Solid Waste

- Others

Solid waste accounts for the majority of the market share due to the abundance of this waste, including organic materials like agricultural residue, forestry waste, and municipal solid waste, which presents a readily available and often underutilized resource for bioenergy production.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Europe enjoys the leading position in the bioenergy market on account of favorable government policies, robust infrastructure, and a strong commitment to renewable energy.

Top Bioenergy Market Leaders:

The bioenergy market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- Archer-Daniels-Midland Company

- Babcock & Wilcox Enterprises Inc.

- Bunge limited

- EnviTec Biogas AG

- Fortum Oyj

- Hitachi Zosen Corporation

- Mitsubishi Heavy Industries Ltd.

- MVV Energie AG

- Ørsted A/S

- Pacific BioEnergy

- POET LLC

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

The Wall